Looking for a simple way to manage your taxes as an employee? The Printable Federal W 4 Employee Withholding Allowance Certificate is a helpful tool that allows you to specify how much federal income tax should be withheld from your paycheck.

By filling out this form accurately, you can ensure that the right amount of taxes is withheld from your pay, avoiding any surprises come tax season. This form is especially important if you’ve had any major life changes, such as getting married or having a child.

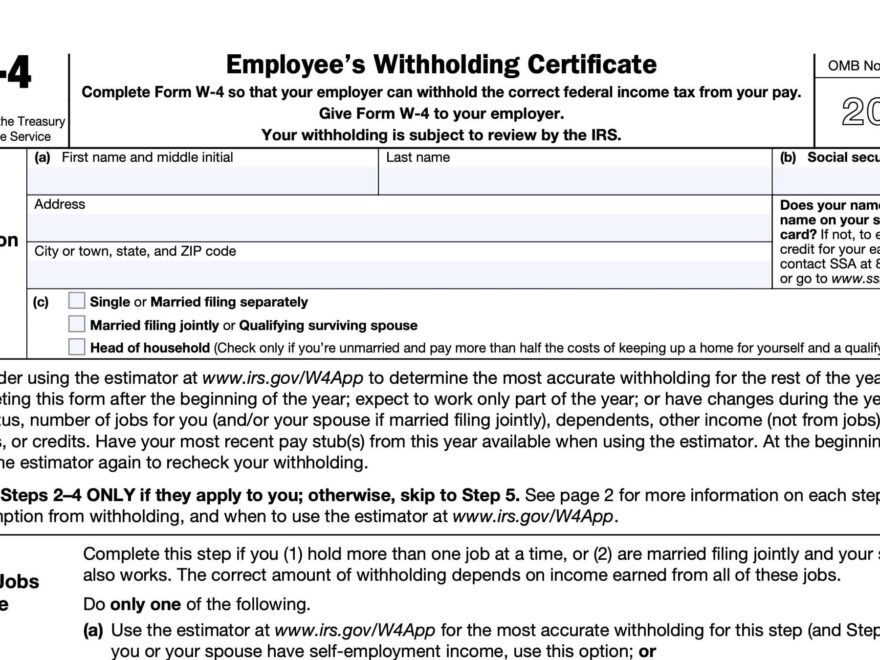

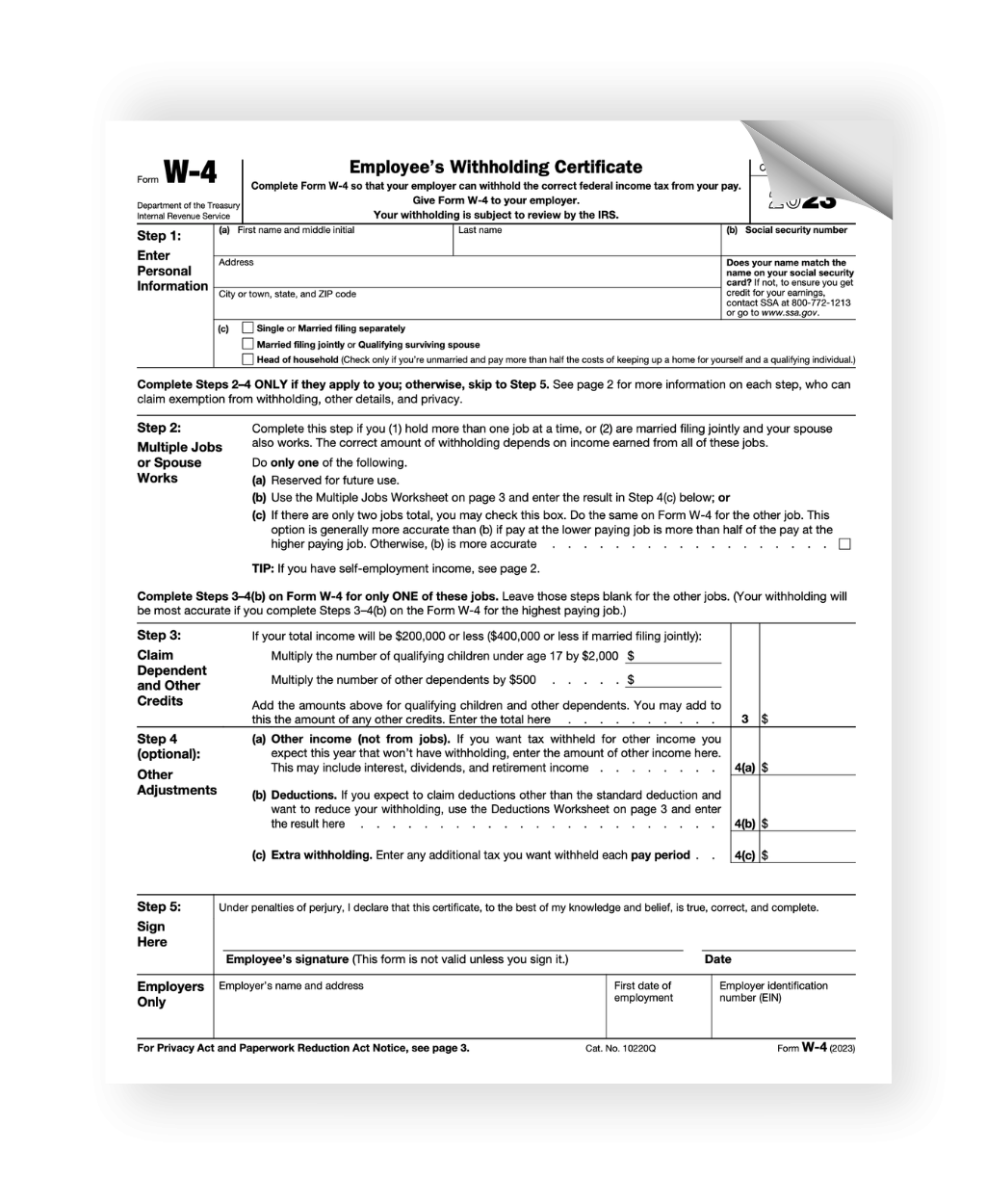

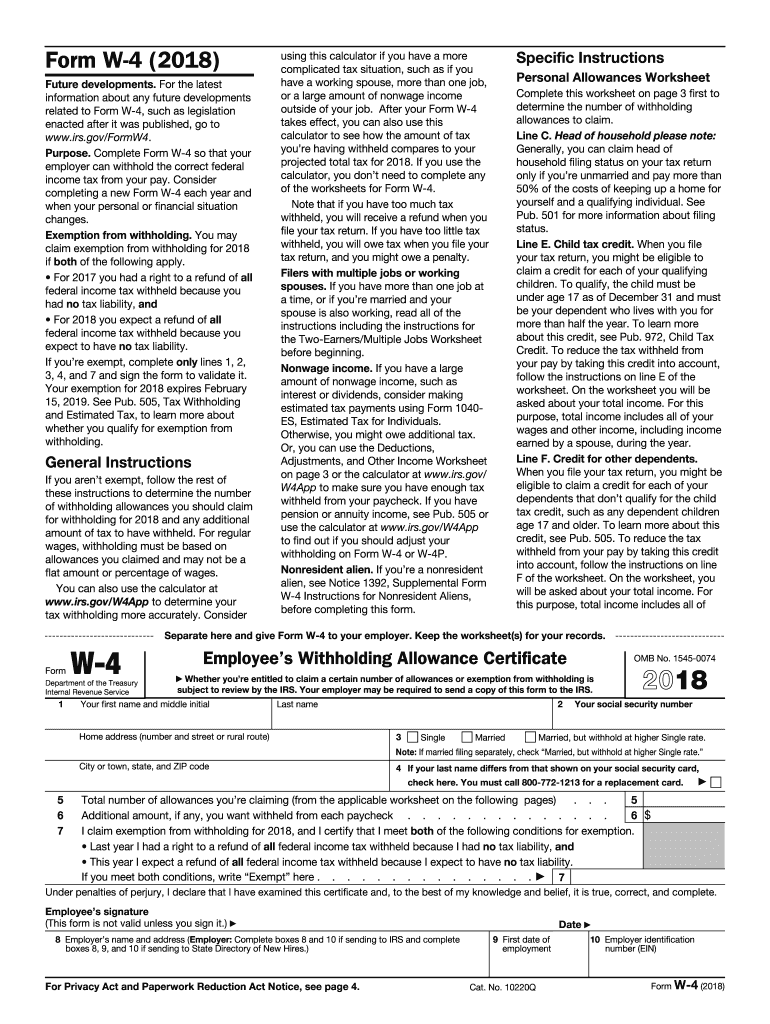

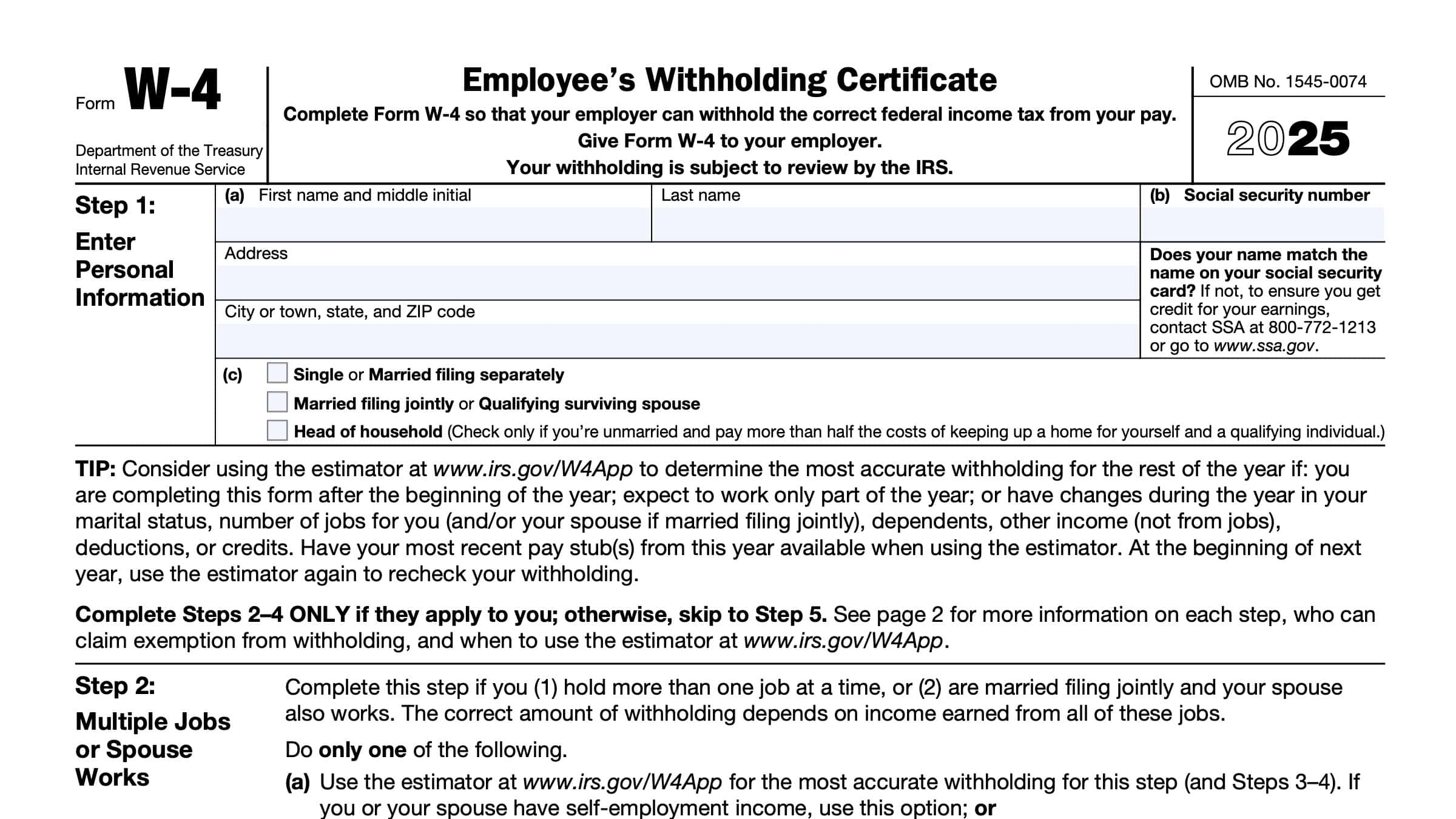

Printable Federal W 4 Employee Withholding Allowance Certificate

Managing Your Taxes with the Printable Federal W 4 Employee Withholding Allowance Certificate

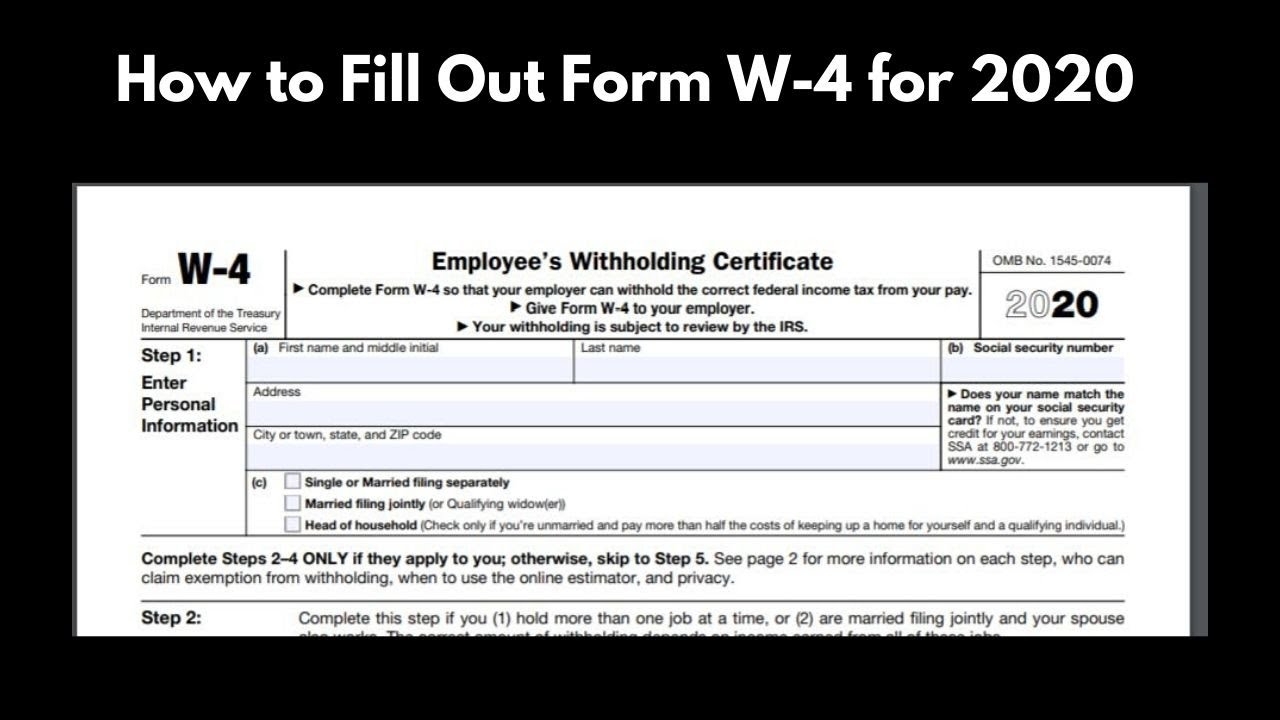

When you start a new job, your employer will provide you with a W-4 form to fill out. This form asks for information such as your filing status, number of dependents, and any additional income you expect to earn. Based on this information, your employer will calculate how much federal income tax to withhold from your pay.

If your financial situation changes during the year, you can always update your W-4 form to ensure that the correct amount of taxes is being withheld. For example, if you get married or have a child, you may be eligible for additional allowances that can reduce the amount of tax withheld from your paycheck.

It’s important to review your W-4 form periodically to make sure it still reflects your current financial situation. If you have too much tax withheld, you may end up with a larger refund at tax time, but you’ll have less money in your pocket throughout the year. On the other hand, if you have too little tax withheld, you could end up owing money to the IRS.

Overall, the Printable Federal W 4 Employee Withholding Allowance Certificate is a valuable tool that can help you manage your taxes more effectively. By taking the time to fill out this form accurately and review it periodically, you can ensure that you’re not overpaying or underpaying your taxes, giving you greater control over your finances.

Take the time to fill out your W-4 form carefully and consult with a tax professional if you have any questions. By staying on top of your withholding allowances, you can avoid any surprises at tax time and make sure you’re not paying more taxes than you need to.

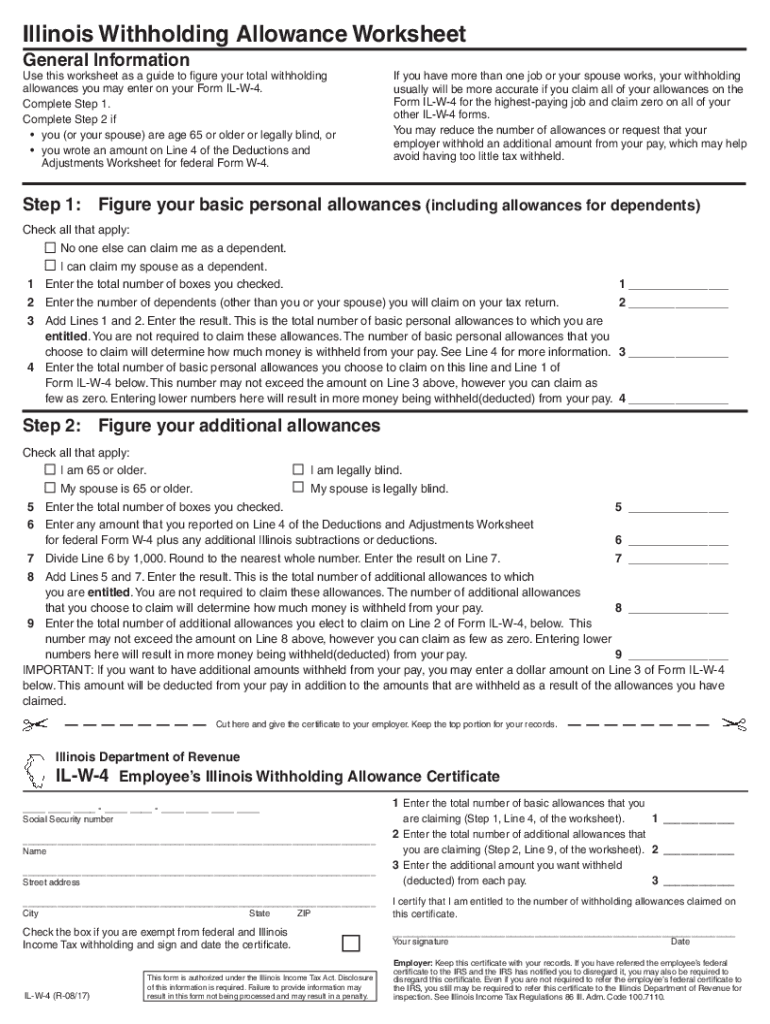

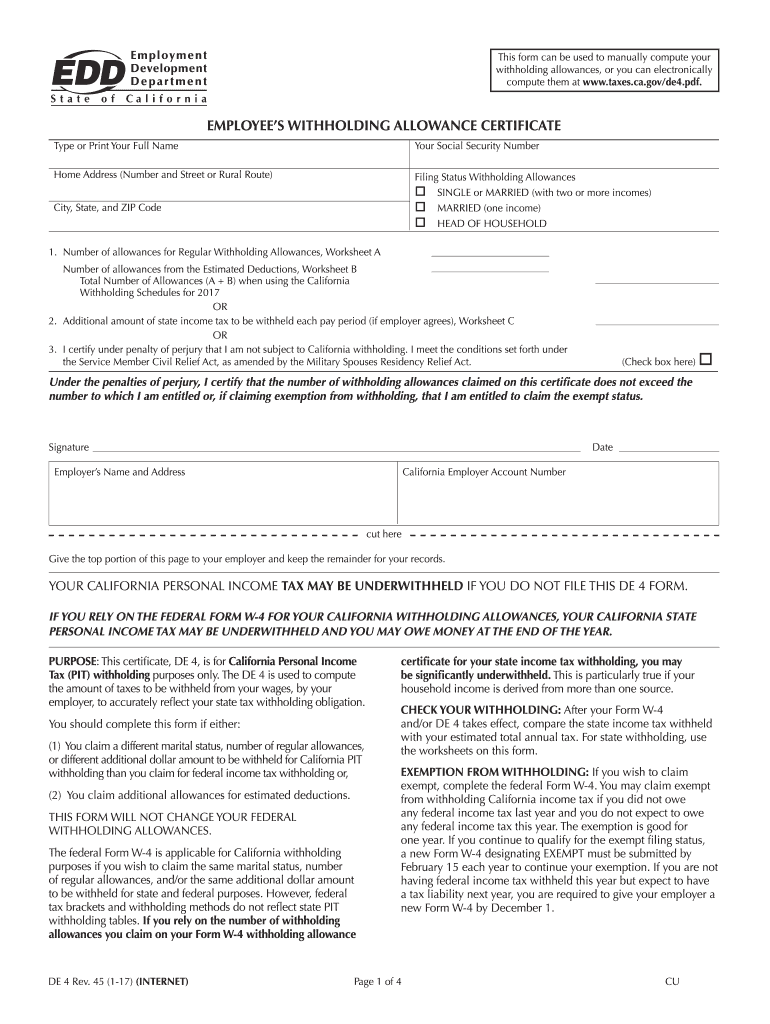

2012 Form CA DE 4 Fill Online Printable Fillable Blank PdfFiller

How To Fill Out The New W 4 Form 2020 Worksheets Library

Useful IRS Forms

W 4 Form 2024 Printable Fill Out Sign Online DocHub

IRS Form W 4 Instructions Employee s Withholding Certificate